Crypto Coin Insurance

Crypto Coin Insurance - First optional crypto change with the possibility of deposit insurance

Hello ... If you are interested in joining a CRYPTOCOIN INSURANCE project or you are interested in joining a CRYPTOCOIN INSURANCE project, it is a good idea to read that can help you find information that might help you in seeing their vision and mission during the CRYPTOCOIN INSURANCE project.

About project

Options are a financial derivative sold by an option writer to an option buyer. The contract offers the buyer the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset at an agreed-upon price during a certain period of time or on a specific date. The agreed upon price is called the strike price. There are many option types. One options can be exercised any time before the expiration date of the option, while other options can only be exercised on the expiration date (exercise date). Exercising means utilizing the right to buy or the sell the underlying security.

Sound so difficult! That’s why this project is divided in two parts: option exchange and insurance company..

Traders and hedge funds conclude deals on purchase and sale of stock options

Other clients, who don’t want to know how option works can purchase insurance for growing or fall of the main cryptocurrencies.

A client pays insurance in the amount of 0.1 Bitcoin for the deposit in the amount of 3 Bitcoins. If the price decreases by 15% within 3 days, he gets the right to get the insurance in the amount of the deposit fall – 0.45 Bitcoins. In case of the insurance event, CRYPTOCOIN INSURANCE pays the client the insurance from the previously obtained insurances. If there has been no insurance event, the insurance paid by the client will be the company’s income.

CRYPTOCOIN INSURANCE

allows you to insure price falls or growth risks for major cryptocurrencies.

Problem: There is no solution to insure the deposit in Bitcoin or Ethereum from falling. At the same time in this market there is increased volatility that makes people be afraid to store large funds in the cryptocurrency. On the other hand, large companies are slow to enter the market (for example, to accept payments in a cryptocurrency) for the same reason.

Solution: The exchange will start operating with 5 cryptocurrencies that have the maximum market. Furthermore, as the demand and turnover increase, we will add other cryptocurrencies. CRYPTOCOIN INSURANCE sells both Bitcoin or Ethereum growth and fall insurance. Thus, it hedges its risk. No competition in the market allows maintaining a significant margin on the level of 20%. CRYPTOCOIN INSURANCE repackages and sells/buys its own risk as options on its own exchange.

CRYPTOCOIN INSURANCE

Problem: There is no solution to insure the deposit in Bitcoin or Ethereum from falling. At the same time in this market there is increased volatility that makes people be afraid to store large funds in the cryptocurrency. On the other hand, large companies are slow to enter the market (for example, to accept payments in a cryptocurrency) for the same reason.

Solution: The exchange will start operating with 5 cryptocurrencies that have the maximum market. Furthermore, as the demand and turnover increase, we will add other cryptocurrencies. CRYPTOCOIN INSURANCE sells both Bitcoin or Ethereum growth and fall insurance. Thus, it hedges its risk. No competition in the market allows maintaining a significant margin on the level of 20%. CRYPTOCOIN INSURANCE repackages and sells/buys its own risk as options on its own exchange.

CRYPTOCOIN INSURANCE

launches the world’s first option cryptocurrency exchange

Problem: There is no special cryptocurrency exchange where you can buy/sell options. The main fear of creating such stock exchange is the increased volatility, too. It seems to everyone who deals with options for stocks, oil or wheat that the risks are enormous.

Solution: The main fear of options in the cryptocurrency market is the increased volatility. But is it really so?

Let us consider an example with the habitual stock market. For example, a client sold an option for a share of the ZZZ Company. Today is Saturday, and the market is closed. There is unexpected good news and the stock grows 2-10 times at the opening of the market on Monday. In its turn, the option seller suffers huge losses.

The advantage of the cryptocurrency market unlike the stock or commodity one is that it operates 24 hours a day. And for the whole period of its existence (about 10 years), there has never been any news that would quickly shift the price of Bitcoin or Ethereum by at least 30-50%. In fact, if it goes only about blue chips (coins), the cryptocurrency market is much safer for option sellers than other markets that we got accustomed to.

Options enable short sales

Problem: There is still no short selling opportunity in the cryptocurrency market. Nobody can sell a cryptocurrency that is physically absent on the account within a short period of time. This reduces the speculators’ ability to smooth price fluctuations in other markets. In its turn it causes the volatility increase and consequences enumerated in cl. 1 and 2 above.

Solution: Without having physical Bitcoin or Ethereum, it is possible to get an option for their falling, and actually carry out uncovered sale. This opportunity brings to the market a lot of new traders, investors and speculators, as well as hedge funds who put money not only on the growth but also on the fall of markets.

Why now?

There are around one thousand exchanges and no option exchange

The rapid growth of hedge funds interest to the cryptomarket is not satisfied because of the lack of options and the possibility of short sales

We have assembled a team of professionals who know everything about the options market and are ready to make on it not revolutionary but innovative changes

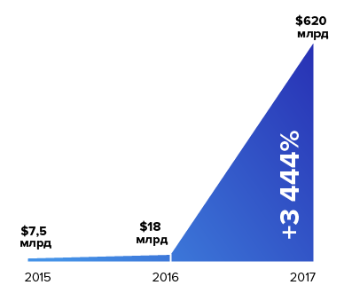

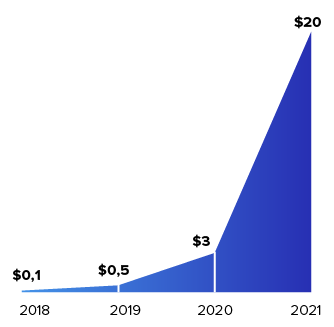

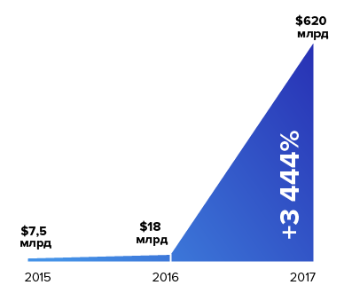

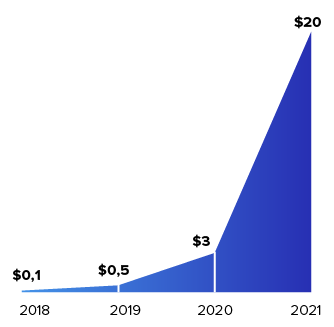

Market size

The capitalization of the cryptocurrency market amounts to hundreds of billions of dollars. The daily trading volume is at the level of $10-20 billion.

The size of the options market for commodities and shares differs from country to country, and is 1-5% of the amount of the basic asset market. Thus, we can calculate the potential volume of the options market for basic cryptocurrencies in the amount of $50-250 million per day.

However, the calculations do not take into account that options actually provide the opportunity for short sales that today cannot be carried out on cryptocurrency exchanges. This will contribute to the additional increase in the sellers’ demand for the instrument.

Monetization

CRYPTOCOIN INSURANCE has two main sources of income

Option Exchange

The profit is generated as a trade commission from each operation on purchasing or selling options. It is 0.5% per transaction or 1% per circle for each of the transaction parties.

Taking into account the volatility of options and huge opportunities for profit, this commission is not significant for market participants. However, it allows the exchange to earn a high income as compared to usual cryptocurrency exchanges due to the total lack of competition. In case of competitors in the future, the amount of the exchange commission can be proportionally reduced.

Insurance Company

The income is generated by selling cryptocurrency growth/decline insurances.

CCIN Token Growth Potential

The CRYPTOCOIN INSURANCE Company has developed a simple and understandable model for the increase in the CCIN token value. 30% of each commission obtained by the option exchange will be directed to the liquidity fund. Within the next month CRYPTOCOIN INSURANCE sends these funds to purchase CCIN tokens from the market and burns them.

This business model is adopted solely in the interests of our investors. The promise to buy tokens from the future profits cannot be transparent. Moreover, the exchange or the platform may never have the profit physically. In case of CRYPTOCOIN INSURANCE tokens, investors know exactly that each option purchase/sell transaction generates the cash flow used to buy tokens.

This allows constantly shifting the market balance and increase the demand for CCIN tokens.

If the turnover is $50 million per day, the commission for both sides of the transaction will be $500,000 or $15 million a month. 30% of this amount or $5 million are sent monthly to buy CCIN tokens from the market.

100 000 000

CCIN tokens will be issued

Problem: There is no special cryptocurrency exchange where you can buy/sell options. The main fear of creating such stock exchange is the increased volatility, too. It seems to everyone who deals with options for stocks, oil or wheat that the risks are enormous.

Solution: The main fear of options in the cryptocurrency market is the increased volatility. But is it really so?

Let us consider an example with the habitual stock market. For example, a client sold an option for a share of the ZZZ Company. Today is Saturday, and the market is closed. There is unexpected good news and the stock grows 2-10 times at the opening of the market on Monday. In its turn, the option seller suffers huge losses.

The advantage of the cryptocurrency market unlike the stock or commodity one is that it operates 24 hours a day. And for the whole period of its existence (about 10 years), there has never been any news that would quickly shift the price of Bitcoin or Ethereum by at least 30-50%. In fact, if it goes only about blue chips (coins), the cryptocurrency market is much safer for option sellers than other markets that we got accustomed to.

Options enable short sales

Problem: There is still no short selling opportunity in the cryptocurrency market. Nobody can sell a cryptocurrency that is physically absent on the account within a short period of time. This reduces the speculators’ ability to smooth price fluctuations in other markets. In its turn it causes the volatility increase and consequences enumerated in cl. 1 and 2 above.

Solution: Without having physical Bitcoin or Ethereum, it is possible to get an option for their falling, and actually carry out uncovered sale. This opportunity brings to the market a lot of new traders, investors and speculators, as well as hedge funds who put money not only on the growth but also on the fall of markets.

Why now?

There are around one thousand exchanges and no option exchange

The rapid growth of hedge funds interest to the cryptomarket is not satisfied because of the lack of options and the possibility of short sales

We have assembled a team of professionals who know everything about the options market and are ready to make on it not revolutionary but innovative changes

Market size

The capitalization of the cryptocurrency market amounts to hundreds of billions of dollars. The daily trading volume is at the level of $10-20 billion.

The size of the options market for commodities and shares differs from country to country, and is 1-5% of the amount of the basic asset market. Thus, we can calculate the potential volume of the options market for basic cryptocurrencies in the amount of $50-250 million per day.

However, the calculations do not take into account that options actually provide the opportunity for short sales that today cannot be carried out on cryptocurrency exchanges. This will contribute to the additional increase in the sellers’ demand for the instrument.

Monetization

CRYPTOCOIN INSURANCE has two main sources of income

Option Exchange

The profit is generated as a trade commission from each operation on purchasing or selling options. It is 0.5% per transaction or 1% per circle for each of the transaction parties.

Taking into account the volatility of options and huge opportunities for profit, this commission is not significant for market participants. However, it allows the exchange to earn a high income as compared to usual cryptocurrency exchanges due to the total lack of competition. In case of competitors in the future, the amount of the exchange commission can be proportionally reduced.

Insurance Company

The income is generated by selling cryptocurrency growth/decline insurances.

CCIN Token Growth Potential

The CRYPTOCOIN INSURANCE Company has developed a simple and understandable model for the increase in the CCIN token value. 30% of each commission obtained by the option exchange will be directed to the liquidity fund. Within the next month CRYPTOCOIN INSURANCE sends these funds to purchase CCIN tokens from the market and burns them.

This business model is adopted solely in the interests of our investors. The promise to buy tokens from the future profits cannot be transparent. Moreover, the exchange or the platform may never have the profit physically. In case of CRYPTOCOIN INSURANCE tokens, investors know exactly that each option purchase/sell transaction generates the cash flow used to buy tokens.

This allows constantly shifting the market balance and increase the demand for CCIN tokens.

If the turnover is $50 million per day, the commission for both sides of the transaction will be $500,000 or $15 million a month. 30% of this amount or $5 million are sent monthly to buy CCIN tokens from the market.

100 000 000

CCIN tokens will be issued

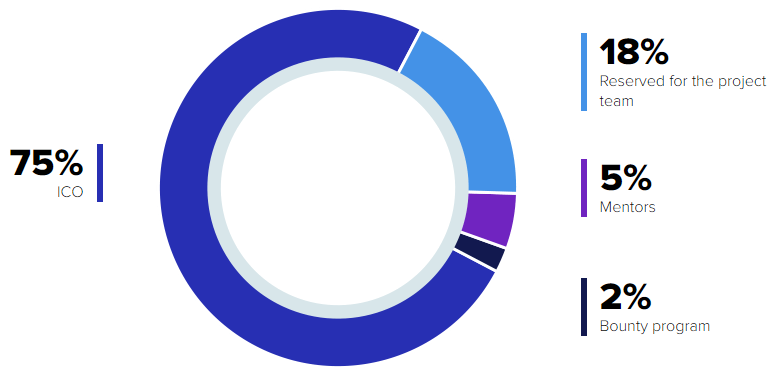

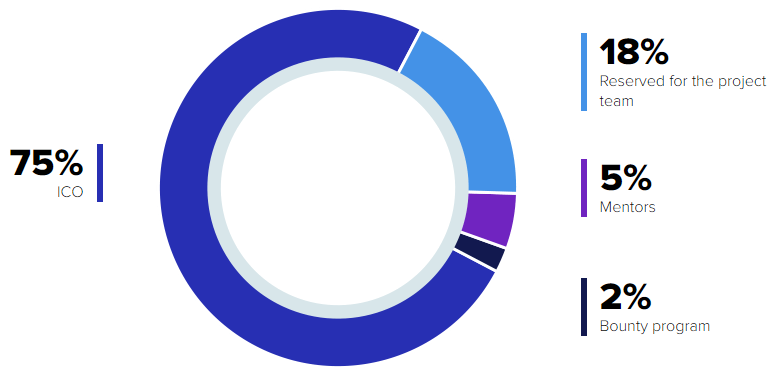

Token allocation

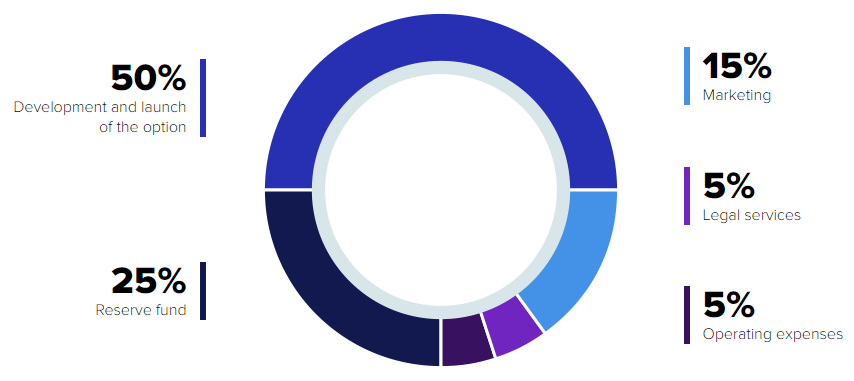

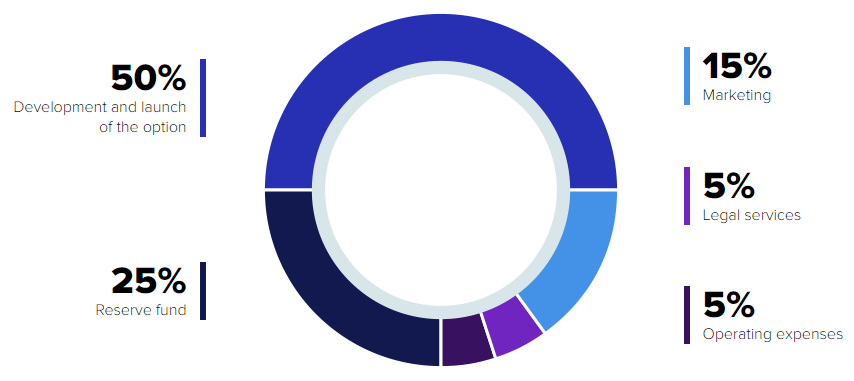

Allocation of the collected funds

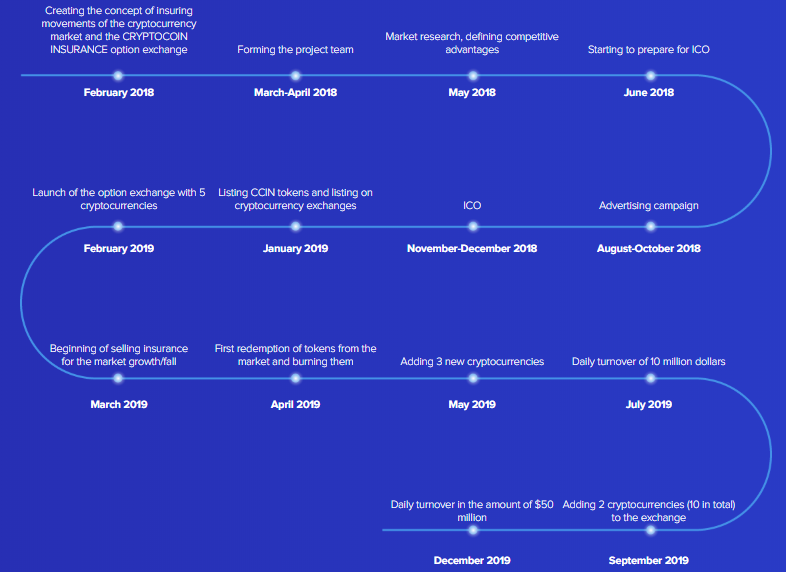

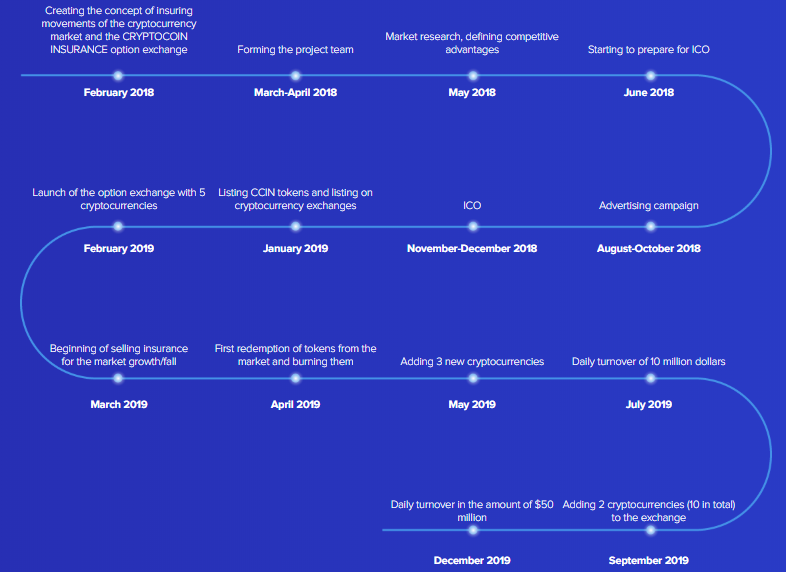

Roadmap

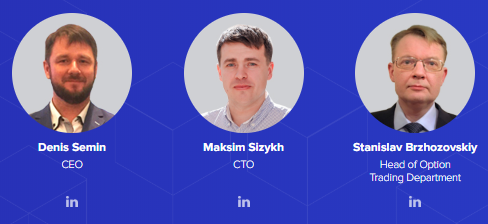

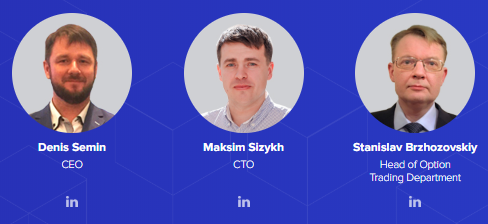

Team project

Here is the information that I present to you in finding information and knowing the CRYPTOCOIN INSURANCE project currently being run by their team, if there is any error in explaining this article, do not worry, I have written to get accurate information. Information and of course you will be able to speak directly with or their team, at the link.

For more information and join CRYPTOCOIN INSURANCE social media today please follow these guidelines:

WEBSITE: http://ccin.io/

WHITE PAPER: http://ccin.io/doc/Whitepapereng.pdf

ANN: https://bitcointalk.org/index.php?topic=4948618

TWITTER: https://twitter.com/ccin_official

FACEBOOK: https://www.facebook.com/ccinofficial/

TELEGRAM: https://t.me/ccin_official

MEDIUM: https://medium.com/@ccin_official

Username: Cevizo

Profile: https://bitcointalk.org/index.php?action=profile;u=1977323

Eth: 0x1ad209D66CDF9f49DB7B87Bd582DA32B2149968D

Allocation of the collected funds

Roadmap

Team project

Here is the information that I present to you in finding information and knowing the CRYPTOCOIN INSURANCE project currently being run by their team, if there is any error in explaining this article, do not worry, I have written to get accurate information. Information and of course you will be able to speak directly with or their team, at the link.

For more information and join CRYPTOCOIN INSURANCE social media today please follow these guidelines:

WEBSITE: http://ccin.io/

WHITE PAPER: http://ccin.io/doc/Whitepapereng.pdf

ANN: https://bitcointalk.org/index.php?topic=4948618

TWITTER: https://twitter.com/ccin_official

FACEBOOK: https://www.facebook.com/ccinofficial/

TELEGRAM: https://t.me/ccin_official

MEDIUM: https://medium.com/@ccin_official

Username: Cevizo

Profile: https://bitcointalk.org/index.php?action=profile;u=1977323

Eth: 0x1ad209D66CDF9f49DB7B87Bd582DA32B2149968D

Komentar

Posting Komentar